Potential returns are dependent on asset and asset compliance by all bankers.įirst funding within approximately one week of confirmed bankers receipt of SWIFT MT760,

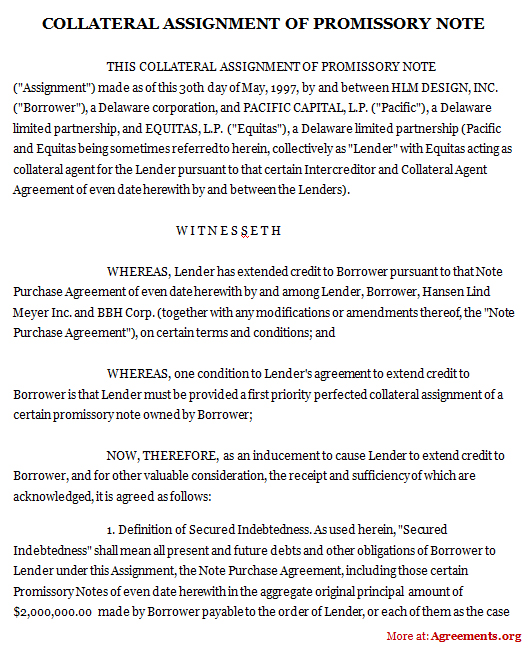

SWIFT NOTE COLLATERAL FULL

Must be assigned to trade entity to trade after acceptance and agreement signed.Ĭash Investor must be bank account holder and signatory.Įuropean Trade Entity may require Tabletop meeting in Europe with Investor t o be discussed after full investor and asset compliance by all bankers and acceptance.Ĥ-5% Percent Per week 30-40% on 41st Week. Investor must be bank instrument beneficiary or owner,īank Instrument must already be issued and in possession of Investors bank. Will review BG, SBLC, MTN bank assets issued by Top 10 Western European Banks or Top World Banks and in possession of investor’s bank. Minimum 10 Million Cash or Bank Instruments Requiredīank’s trading entity prefers cash. OR EMAIL PROVIDERS REP AT 10M Minimum Non Recourse Private Trade Funding PLEASE CONTACT THE REP WHO REFERRED YOU TO THIS POST Reports Profitable First Quarter and Strengthened Balance Sheet () Property Value Declines Prompt Lenders To Renegotiate and Extend Balloon Payment Loans ().Close a Deal By Suggesting Financing Options ().Provider cannot initiate an MT799 from Provider side to get the pay order started. No exceptions.Ĭlients trying to use Provider’s instrument to activate a credit line to pay for the instrument does not work.

NOTES: Proof of Funds required with documents. Funds are released upon receipt and satisfaction of receiving bank. B To Consultant’s New York Attorney Paymasterĥ. Client prompts his banker to Swift ICBPO for:

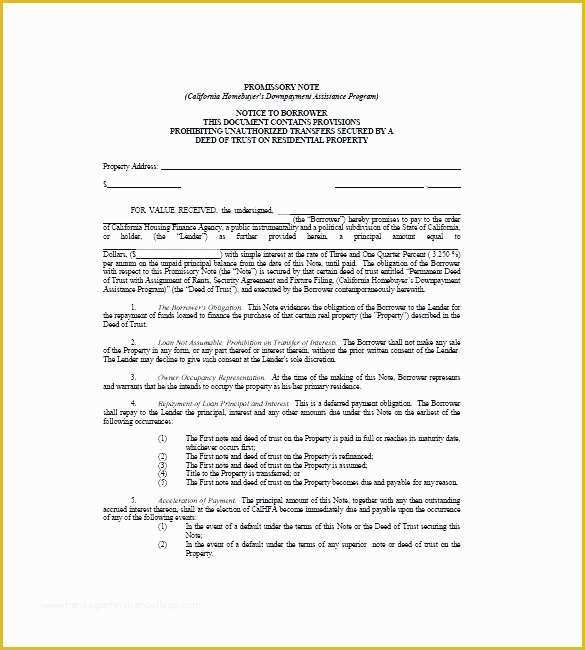

Investor/Provider contract is issued with investor’s bank coordinates.ģ. After approved compliance of funds and client file by Investor/Provider bankers, Provider will send service agreement – Sample available.ģ. – Buyers receiving banker may include MT760 verbiage.Ģ. – Buyer’s Banker’s letter and approval of provider’s ICBPO verbiage for bank fees and broker fees with statement banker is RWA to send ICBPO. – Bank Statement Proof of Funds for 12% of face value orīanker Signed Comfort Letter Proof of Capability for 12% of face value. Summary of Transaction (what bank instrument will be used for) Current Banks: Deutsche Bank and Credit Suisse No fees or costs until receiving bank confirms. Providers with specific banking relationship with the Top Western European and Prime World Banks make these assets available to clients to borrow/lease for a fee based on contract size/face value and term of usage. Reps are protected.īalance Sheet Credit Enhancement and Collateral for Project Funding San Diego, California based provider will be fully transparency to buyer.Ĭontact for application to be sent directly to buyer. If we have this, we can note if we are relaying the instrument through a top bank and which one. Most important is buyers receiving banking destination. 1% Buyerside Open)įunds are escrowed with attorney- bonded escrow agent in New York at HSBC, and not touched until the instrument is delivered. Providers/Investors with specific banking relationship make these assets available to clients to borrow/lease for a fee based on contract size/face value and term of usage.īank has over $6 billion in assets and corresponds with many Top Tier World Banks, such as Societe Generale and Standard Bank SA. BANK GUARANTEES, STAND BY LETTERS OF CREDITįor International Trade Settlement, Balance Sheet Credit Enhancement and Collateral for Project Fundingīank Instruments such as Bank Guarantees and Standby Letters of Credits are available privately for settlement of International Trade Transactions, Balance Sheet Credit Enhancement and Collateral for Project Funding.

0 kommentar(er)

0 kommentar(er)